Healthcare mergers and acquisitions (M/A) are a significant part of the overall change in the recent U.S. healthcare landscape. Financial distress and the need for the economic viability of the acquired hospital are the main drivers for M/A.

The bigger hospital, which is acquiring a more minor system, hopes to increase its service lines and market share to improve overall profitability.

The larger hospital systems continue to “swallow up” smaller rivals in these M/A across the U.S. What is the economic implication of this buying frenzy? How does it affect patients and healthcare costs?

These more prominent hospitals promise better access to increased patient service lines and enhanced financial stability for the acquired hospital[] How well do these M/A improve general patient care and healthcare access? Do their promises add up to reality after the completion of these M/A?

This article is a deep dive into answering these questions.

Breaking Down the Issue: the failures of healthcare Mergers in enhancing public health outcomes.

Although there are potential advantages to the quality of care resulting from M/A, the reality is far from the benefits.

The National Bureau of Economic Research (NBER), using data from the Health Care Cost Institute and federal government insurance premium statistics, provided some insights on M/A[2].

They discovered that a single hospital merger equals an average of 39 lost jobs and $6 million in lost wages. It also increases insurance premiums due to the increased cost of health care services rendered by the merged hospital system in the setting of quashed competition.

Each merger caused the cost of care to rise 1.2% nationally on average. This leads to less taxable income and more public health expenses for the local governments [2].

Middle-class families are even more disadvantaged in this scenario because they don’t qualify for Government health coverage/Medicaid and can’t afford private insurance because they are out of a job.

Other published evidence also suggests an overall negative effect of M/A on quality of care and mortality following decreased hospital competition [2,3]. There is also evidence that mergers do not lead to substantial cost savings [4].

How Healthcare mergers and acquisitions impact digital health infrastructure and patient data

M/A’s impact on digital health infrastructure is most profound on the electronic health record systems (EHR). Most M/As involve more extensive systems acquiring smaller hospitals.

These smaller systems are likely to be in different geographical locations and use other electronic health record (EHR) systems than those of the acquiring hospitals.

Connecting EHR systems, even when using the same EHR, is usually one of the most significant challenges in every M/A. Most smaller hospitals’ legacy systems were not built with interoperability (the ability to connect and share information) in mind.

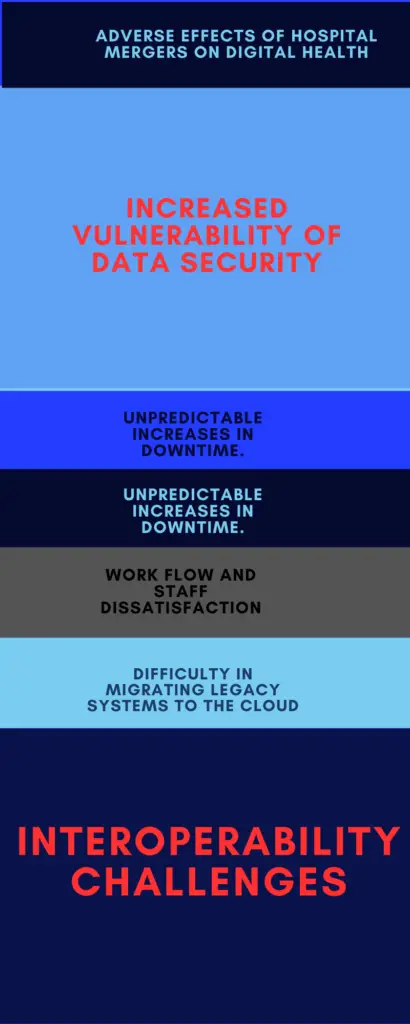

Below are some of the challenges to EHR and other digital health infrastructure that result from M/A.;

1. Inability to achieve interoperability: Interoperability is connecting efficiently between different systems enough to share information seamlessly. This is very important for high-quality patient care. In fact, without intersystem connectivity, we will continue to dwell in our disparate health silos without reaping the benefits of healthcare digitization.

Interoperability is an important mandate of the 21st Century Cures Act for every EHR system in the U.S. through the FHIR API system [5].

M/As come with heavy interoperability challenges mostly because both healthcare systems usually have different EHR systems with other standards, making combining them an information technology nightmare [6].

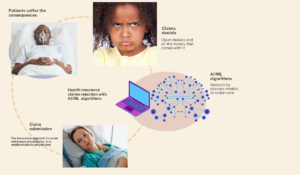

This lack of system integration results in a high cost of care due to redundancy and waste. When patient records don’t transfer across systems, tests and investigations are unnecessary repetitions.

Many expensive tests, such as repeat MRIs and C.T. scans, are repeated daily across health systems because of a lack of access to the same tests done two days prior in a facility less than five miles away.

2. Increased data security vulnerability: Most smaller hospital systems acquired have legacy systems that run on outdated digital infrastructure. These older systems are not optimized to connect with other systems safely.

These attempts to connect the legacy and up-to-date systems of the more prominent hospitals result in security vulnerabilities that are difficult to identify, which allows for cyber-attacks and data security breaches [6].

3. Difficulty with vendor harmonization: Most merging systems work with varying digital health vendors for the different systems they run. M/A then accumulates many “strange” vendors without a prior relationship with them.

4. Workflow disruption and staff dissatisfaction: These adverse changes hinder staff’s ability to perform their duties. Everybody is impacted, from the administrative to the clinical staff, and this aspect of M/A does not get enough attention from upper management.

5. Difficulties in migrating legacy systems to the cloud: As the healthcare industry embraces cloud data storage instead of traditional on-site storage, it becomes necessary to migrate not only electronic health record (EHR) data but also other critical enterprise systems such as human resource, financial, revenue cycle, sales, and marketing data.

Cloud systems offer advantages such as enhanced security, efficiency, automation, and the ability to use data for analysis and artificial intelligence. However, integrating the legacy systems of acquired hospitals into the cloud poses a challenge. This can hinder practical business intelligence analysis, which may put the integrated system at a competitive disadvantage[7].

6. Ineffective backup and restore processes: Every hospital system should have an efficient backup and restore mechanism to address unexpected system failures. However, integrating systems during mergers and acquisitions can lead to problems in creating an effective backup and restore process.

7. Unpredictable downtime: An efficiently run information technology (IT) department should have knowledge of its risk level and the possibility of unexpected downtime. However, with mergers and acquisitions, preparing for all potential risks becomes complicated, increasing the likelihood of downtime.

This downtime can have detrimental effects on both clinical and support services.

Expert guide to enhancing healthcare quality through strategic mergers and acquisitions.

M/A stifles competition and impacts healthcare quality. It’s unstoppable and a consequence of the broader change in the health economy and regulations. It’s not all gloom, as there are evidence-based strategies that can result in successful M/A.

A complete integration approach to mergers is the only proven way to reduce the harmful effects resulting from M/A.

This approach involves a proactive effort to integrate management, operations, organizational culture, and digital health/data systems before initiating M/A[2].

Every M/A that proceeds without this full integration approach risks worsening the overall public health of the patients served by the acquired hospital.

Digital health 360 degrees lens;

M/A comes with many public health and digital health issues, including job loss, increased healthcare costs, reduced access, and lack of health data interoperability with care redundancy—all of which result in reduced overall quality of public health. Nevertheless, M/A is here to stay due to corresponding changes to the overall socio-political and economic landscape. Many smaller systems are struggling financially, especially after the volatility brought on by the recent COVID-19 pandemic. A paradigm shift in how we conduct M/As is needed to reduce health disparity and improve health access. These M/As primarily impact rural and inner-city hospitals. Patients in these areas already struggle with access to care, and M/As worsen their inequity further. A merger conducted using a full integration approach is the only way to ensure a successful M/A. This involves proactively integrating the managerial, operational, and digital systems before initiating the M/A. This principle does not prioritize only the bottom line, which appears to be the only factor considered at the expense of quality care.References

1. Possible benefits of Mergers. AHA https://tinyurl.com/32s23pw6

2. Who pays for the cost of mergers? NBER; https://www.nber.org/papers/w32613

3. Quality and safety outcomes of a merger. Wang. JAMA;https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8739764/

4.Megers generate small cost savings. NBER. https://www.nber.org/digest/oct18/hospital-mergers-generate-relatively-small-cost-savings

5.HHS and Interoperability; https://tinyurl.com/bdd5zd38

6. How healthcare mergers affect interoperability. Definitive health. https://www.definitivehc.com/blog/healthcare-mergers-acquisitions-ehr-interoperability

7.Healthcare and cloud computing; Sachdeva; https://www.ncbi.nlm.nih.gov/pmc/articles/PMC11004887/